- QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN SOFTWARE

- QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN PLUS

QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN SOFTWARE

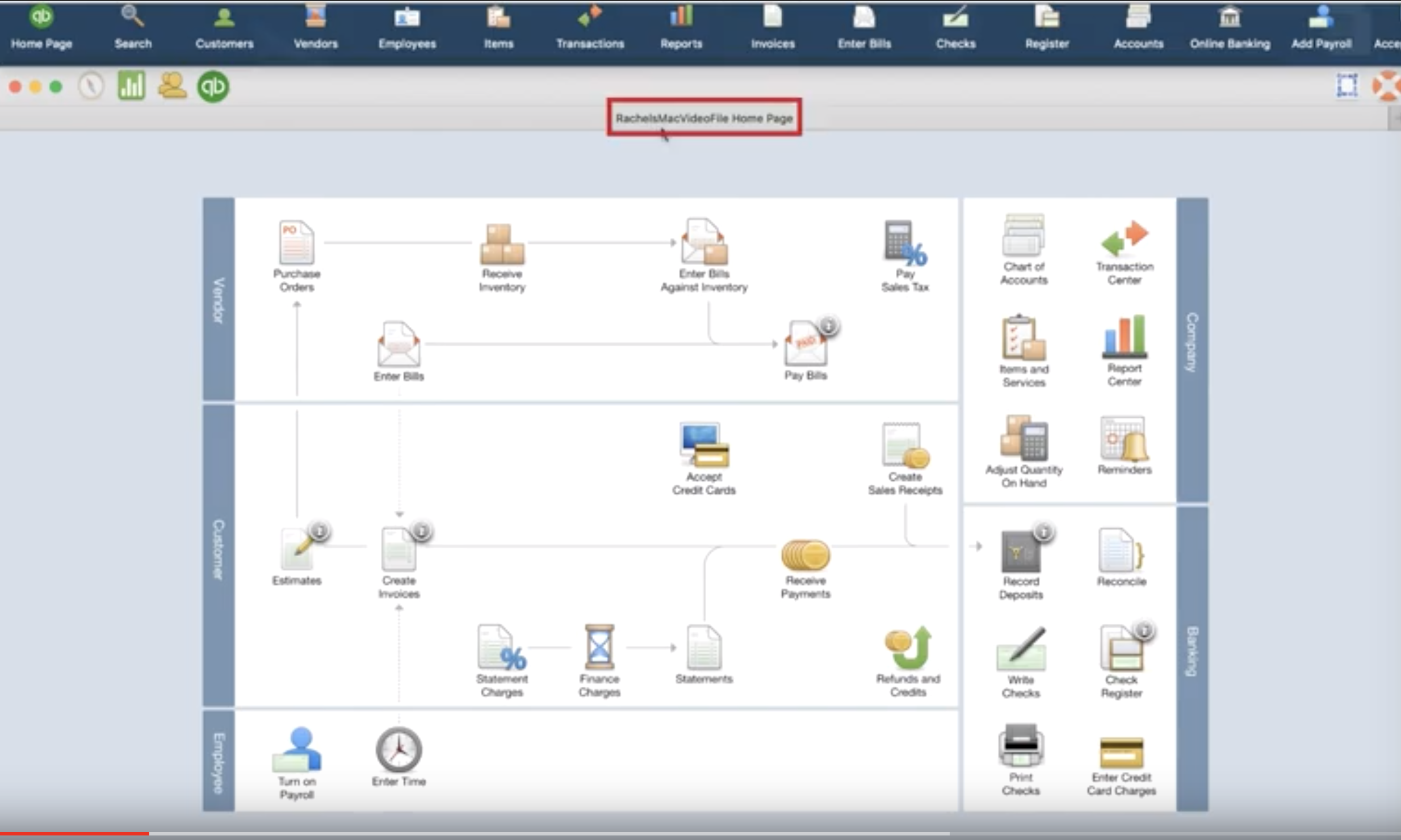

QuickBooks Desktop is designed for small to mid-size businesses that are looking for the reliability of a desktop software solution. Originally designed for very small businesses that desired easy online access, web based QuickBooks Online has evolved into a solid small business accounting application that is easy to use and can be quickly accessed from any location on any type of device. But aside from cloud access, there are other differences between the two applications that we’ll talk about next. While many QuickBooks Online aficionados cite anytime/anywhere access as one of the main benefits of going with QuickBooks Online, keep in mind that QuickBooks Desktop can be hosted on a virtual server if you’re looking to combine the reliability of a desktop application with easy cloud access. While both provide easy access to a variety of features and functions, only you can decide which one will work best for you. When you do, you’ll notice the difference immediately as QuickBooks Online offers a streamlined user interface, while QuickBooks Desktop relies on a flow-chart based interface. Whether you’re thinking about converting to QuickBooks Online or switching from QuickBooks Desktop to QuickBooks Online, your first step should be to take a long look at both applications. QuickBooks Online and QuickBooks Desktop are both excellent small business accounting software applications, both offering complete double-entry accounting as well as automatic processing of closing entries. Join us as we compare QuickBooks Online to its desktop counterpart in an effort to help you decide between these two popular small business accounting applications. Save over 30 hours a month: Based on a survey of small businesses using QuickBooks Online conducted August 2019 who stated average savings compared with their prior solution.While people may assume that QuickBooks Online is simply the cloud version of QuickBooks Desktop, in reality, the two products are very different. Save over $3,500 at tax time: Claim of $3,500 savings based on average tax year savings of $3,563 for QuickBooks Self-Employed customers that had business expenses and owed taxes in 2019.Īuto-sort transactions. customers using QuickBooks Online invoice tracking and payment features from Aug 2019 to Jul 2020. Get paid 2x faster: Getting paid 2x faster based on U.S. Terms, conditions, features, pricing, service and support are subject to change without notice.įorecast cash flow up to 90 days out: Cash flow planning is provided as a courtesy for informational purposes only. Additional terms & fees may apply for third party apps.Terms, conditions, pricing, features, service and support are subject to change without notice. To cancel your subscription, contact us here.

QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN PLUS

Upon activation of the QuickBooks Online Advanced Payroll service, your subsequent payroll charges will be $20 plus $2 per employee per pay run until you cancel. A valid credit card is required to continue using QuickBooks Online Payroll. The $2/employee fee is charged per unique active employee that has run a payroll during the monthly billing cycle. Upon activation of the QuickBooks Online Payroll service, your subsequent monthly charges will be $20 + $2/employee in addition to your QuickBooks Online subscription cost, plus all applicable taxes, until you cancel. Based on TY17 CA subscribers that have identified >$10k in income and >$0 in business expenses.Only credit card payments in Canadian dollars can be accepted. Data access is dependent on Internet or cellular provider network availability. Online services vary by participating financial institutions or other third parties, and may be subject to application approval, additional terms, conditions, and fees.Following this period, you won’t be charged for your subscription. You’ll have access to your account through the end of your current billing period. If you’re not satisfied with QuickBooks Online or QuickBooks Self-Employed for any reason, you can cancel your subscription within the product if you purchased your subscription directly from Intuit, or through the app store (iTunes or Google Play) if that’s where you purchased your subscription. If you add or remove services, your services fees will be adjusted accordingly. After the discount period, you will be automatically charged at the then-current fee for the service(s) you’ve selected, unless you cancel. The monthly subscription price excludes HST/GST. *The above discount offer is available only to new QuickBooks customers, for the first 3 months of the subscription, and cannot be combined with any other QuickBooks Online offers.

0 kommentar(er)

0 kommentar(er)